AI Investment Trends

When it comes to AI investment, there's no shortage of cash, excitement, and, well, ups and downs. We’ve seen sky-high peaks, sudden drops, and some steady (but still massive) piles of cash being thrown at AI. Let’s dive into the data and see what’s been happening over the past decade—and maybe have some fun with those numbers too.

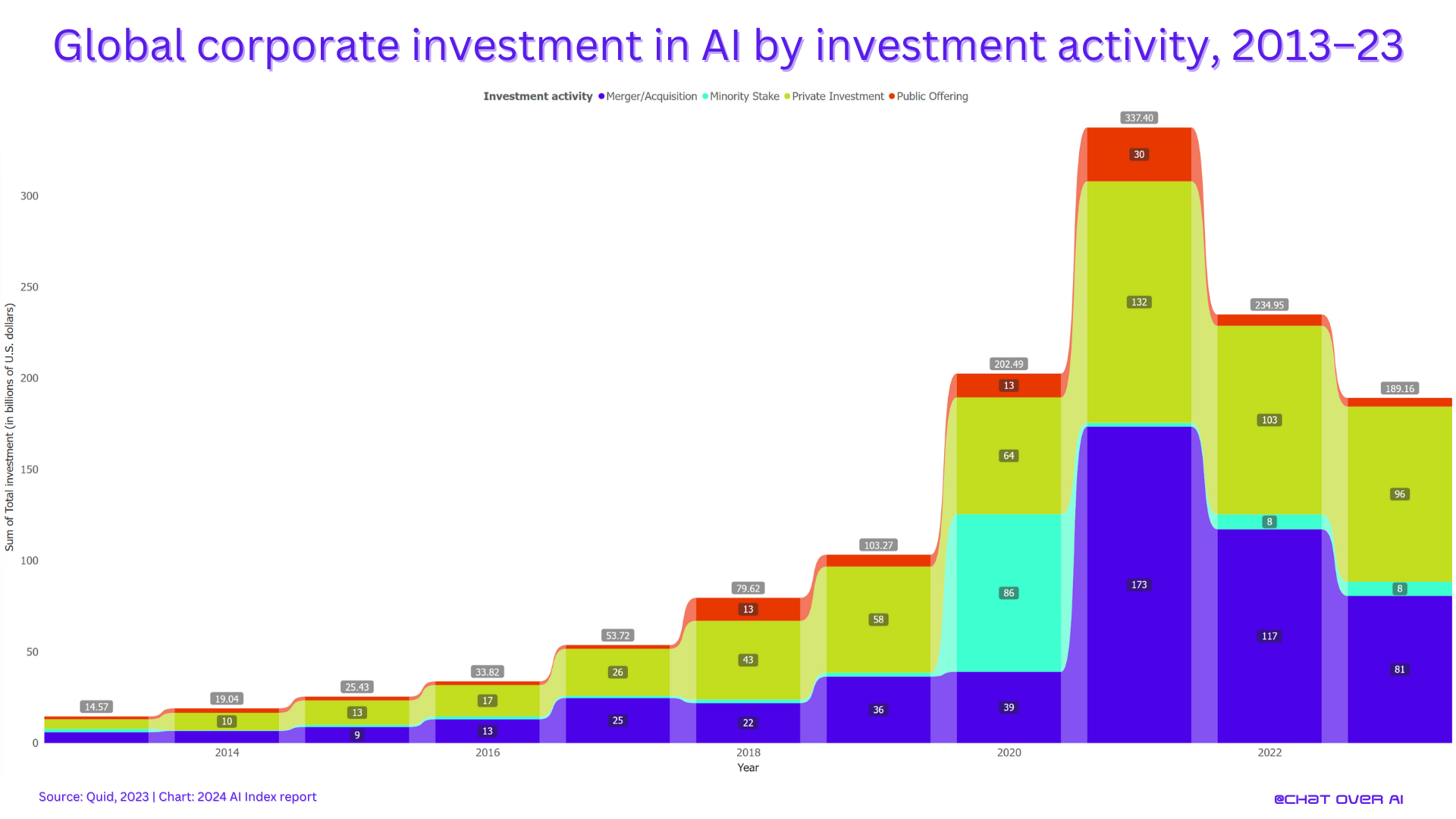

"The AI Rollercoaster: Global Corporate Investment from 2013 to 2023"

First up, gives us a view of global corporate AI investments from 2013 to 2023, and let me tell you, it’s been a ride. Picture a rollercoaster that started off as a kiddie ride and, over the last decade, has turned into something that would terrify even the bravest thrill-seeker.

Thanks for reading Chat Over AI! Subscribe for free to receive new posts and support my work.

2023 saw a dip in total investment, dropping to $189.2 billion—a solid 20% decrease from 2022. And the biggest contributor to that dip? Well, it turns out that mergers and acquisitions have been a bit shy this year, declining by 31.2%. But hey, if we look at the bigger picture, the thirteenfold increase in investments over the past decade is still enough to get any investor to start practicing their robot dance. It’s not all bad news—it's just that AI investors are maybe getting a little more selective with their billion-dollar bills.

"Private Investment: The AI Enthusiasts Who Keep the Cash Flowing"

Private investment in AI has also experienced a bit of a slowdown, but nothing too dramatic. The drop from 2022 to 2023 was a modest -7.2%. To put it in perspective, it’s like going from having a full tank of gas to having three-quarters left—still plenty to go around. Over the last decade, though, we’ve seen a meteoric rise in private investment in AI. Back in 2013, it was a cute $5 billion, and now we’re talking $96 billion. So, despite some bumps along the way, the trend is still headed up—and those investors are clearly still into AI, even if the honeymoon phase has mellowed out a bit.

"Startup Boom: Newly Funded AI Companies Around the World"

This is where things get really spicy. shows the number of newly funded AI companies globally, and 2023 saw a major jump—1,812 newly funded AI companies, marking a 40.6% increase from the previous year. It’s like everyone suddenly remembered that AI was the cool kid in town and decided they wanted to be friends. It’s impressive, and also a reminder that even when the investment volume slows a bit, the number of players wanting in on the AI game keeps growing. AI startups are popping up like mushrooms after a rainstorm, each one with a bold promise to make the future smarter, faster, and maybe just a little more algorithmic.

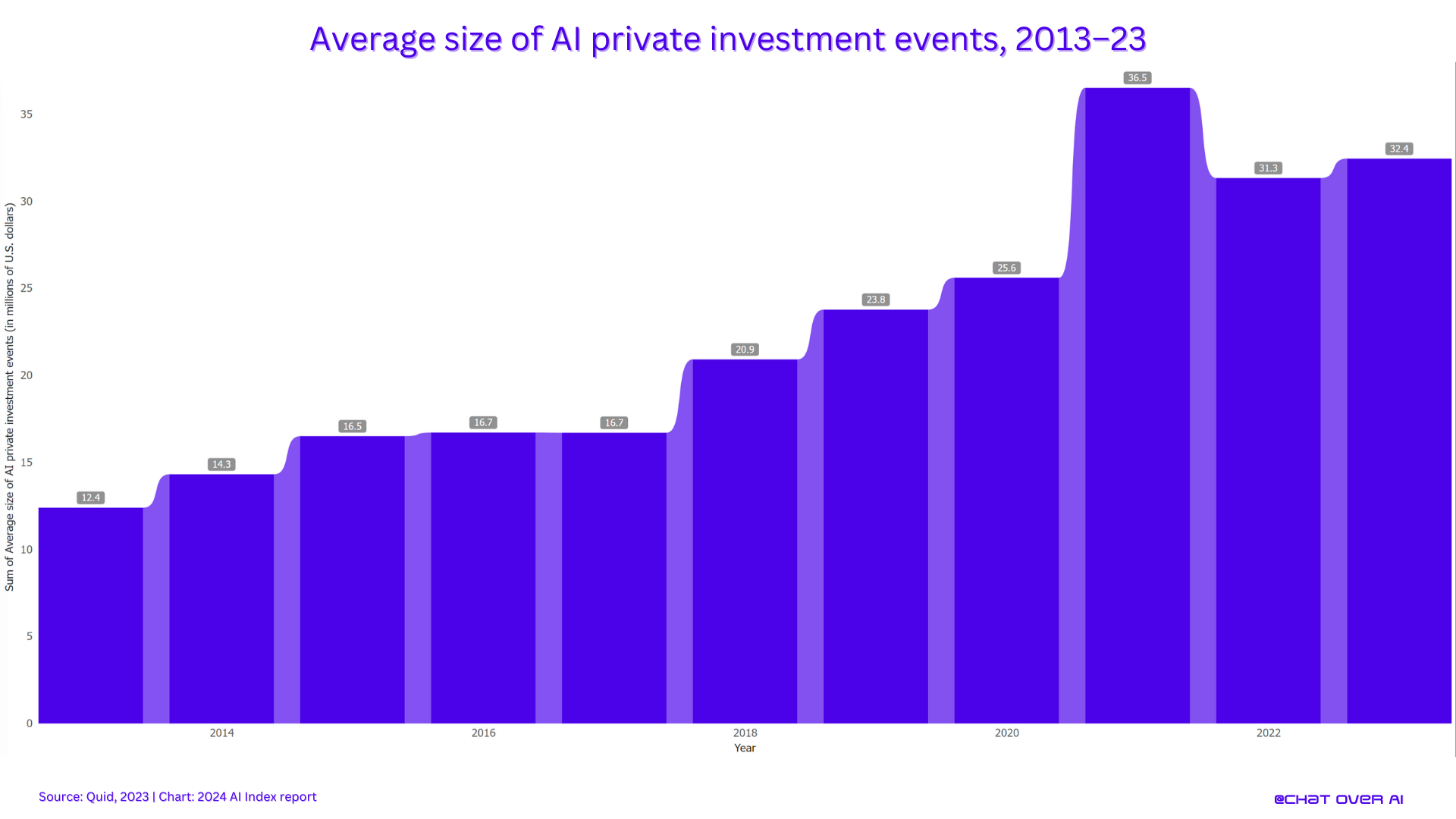

"How Big Are the Bets? The Average Size of AI Private Investment Events"

Now let’s talk about the average size of private investment events. shows us how the size of these investments has evolved over the years. From 2013 to 2023, the average private investment grew from $12.4 million to $32.4 million—that's nearly tripling. The latest data, from 2022 to 2023, shows a slight increase, growing from $31.3 million to $32.4 million. You could say investors are getting more comfortable making it rain (in a controlled, calculated way). It’s as if everyone agreed, “Why not add a couple of extra million? What’s a few more bucks between AI enthusiasts?”

What Does It All Mean?

To add a bit more context, the recent decline in AI investments is not entirely unexpected. Given the economic uncertainties and global shifts in market conditions, investors are becoming more cautious. The decline in mergers and acquisitions reflects this hesitation, with companies reevaluating risk and focusing on core strengths.

It's also worth noting that, despite the overall dip, AI remains one of the most promising sectors for long-term returns. The AI software market alone is projected to grow to $126 billion by 2025, fueled by increasing adoption across industries—from healthcare to autonomous vehicles. Big players like Google, Microsoft, and OpenAI are still making substantial bets on AI technologies, especially in generative AI and language models, which are continuing to attract both attention and funding.

Another interesting point is the rise of AI applications in unexpected industries. For instance, agritech has seen a surge in AI integration, helping farmers optimize yields and reduce waste. This sector alone attracted significant venture capital in recent years, showing how AI's scope continues to broaden. If you’ve been reading between the lines, it’s clear that AI investment is a lot like a tech-themed soap opera: there are ups, downs, new players, and old alliances falling apart. But, above all, it’s dynamic. Even with recent dips, the general trajectory is upward—and the thirteenfold growth over the decade speaks for itself.

The rollercoaster might be taking a dip at the moment, but make no mistake, the AI hype train is still very much on the tracks, picking up passengers. Investors are being more strategic now, yes, but the excitement hasn’t vanished—just look at the 40.6% increase in newly funded AI companies in 2023. Clearly, folks are eager to create the next big thing in AI, and the tech's potential hasn’t lost its shine.

Conclusion: Show Me the Money!

If there’s one thing we’ve learned from looking at these charts, it’s that AI investment is a complex, ever-changing beast. The total investment may have taken a dip, but the average investment sizes are going up, and the number of new startups entering the fray is skyrocketing. It’s all part of the growing pains of a rapidly maturing industry. So buckle up—there are sure to be more twists, turns, and exciting funding news to come. Whether it’s a rollercoaster or a rocket ride, the AI investment landscape is a show worth watching.

Thanks for reading Chat Over AI! Subscribe for free to receive new posts and support my work.